Despite being a good car rider, there is a chance of being involved in a car accident, whether there was a mistake or not. As we cannot predict the future, keeping yourself safe is the best way to prevent accidents. Acko Car Insurance provides an immediate solution by following the law that settles the claim. This article details the claiming process, requirements, documents, procedures, etc.

What is Acko Car insurance?

Car insurance provides financial security for a vehicle in case of unpredictable accidents. The Acko General Insurance Company, the first digital insurance provider, provides Acko Car Insurance. Acko Technology and Services PVT is the parent company of the Acko Digital Insurance Company, founded in 2016. Becoming the first-ever direct-consumer service company is trusted by more than 6.2 crore people.

Customers can get car insurance that covers damage costs, repair charges, and third-party liability protection through this company. Whatever the reason for the car damage, the company provides insurance that gives you financial stability over the vehicle you own. The best thing about this insurance is that it can cover the charges of a third party involved in the accident with your vehicle.

Features:

There are a few important features of Acko Car Insurance, and they are,

- This insurance covers the damage and repair costs if any accident is done on your own.

- The third party involved in the accident can also obtain liability insurance through this claim to provide financial safety.

- This insurance covers the compensation if anyone is hurt or dead in the accident.

- The vehicle can be picked up at the nearest repair shop for free, which is cashless but applies only to certain cities.

- Acko settles the insurance claim in 12 minutes, becoming the fastest insurance service.

- Customers can get free vehicle towing to 50 Km, which makes it easier.

Types of Acko Car Insurances:

There are two primary Acko Car Insurance services they are,

- Cashless Insurance Claim: As its name suggests, this is a Cashless claim, where the customers can get their car repaired in Acko’s network garages. Through this claim, the cars are repaired by picking up the vehicle from the location and drops after the repair. This also covers some minor replacements like the mirror and the dent of the bumper.

- Reimbursement: Through this claim, customers can select their repair garage in any city and complete their repairs. After completion, you must submit the repair receipt by logging in to the portal or app. After the verification, you can get the agreed reimbursement.

Documents required:

The following are the important documents the customer must submit to claim Acko Car Insurance. They are,

- Car insurance policy copy

- FIR from the Police

- Copy of the Driving license document of the driver

- Duly filled and signed form

- Receipts/bills of car repairs

- Car Registration document copy

- Medical recipes in case of any injuries

- Proof of Identity

- Cancelled cheque

- Picture of the accident and vehicle.

How to claim Acko Car Insurance?

Acko Car Insurance customers must follow different steps for different types of claims. As there are two types of claims, like Own damage claim and third-party claim, the procedure varies from one to one. They are,

For Own damage claim:

- Firstly, open the Acko official website or app to raise the insurance claim about the extent of the insurance claim.

- Then, file the FIR at the nearest police station and get a copy of it, as it is an important document.

- Then, submit the documents related to the car and accident.

- Next, the insurance officer inspects the car after verifying the documents.

- Finally, you can receive the claim after the car is fixed.

Third-party claim:

If a third party causes the accident or damage, you can claim personal injury or property damage insurance. After completing the process, the insurance company decides on the compensation. The procedure for claiming third-party insurance is as follows,

- Firstly, get the details about the third party, including their insurance details, and inform their company.

- Next, inform your insurance company about the damage through a website or app.

- Then, file a First Information Report (FIR) at the nearest Police station of the accident and submit it to the company.

- Next, submit other important documents for verification, and the Motor Claims Tribuna will decide on the compensation.

How to raise a claim?

Follow the below steps to raise the claim in Acko Car Insurance easily,

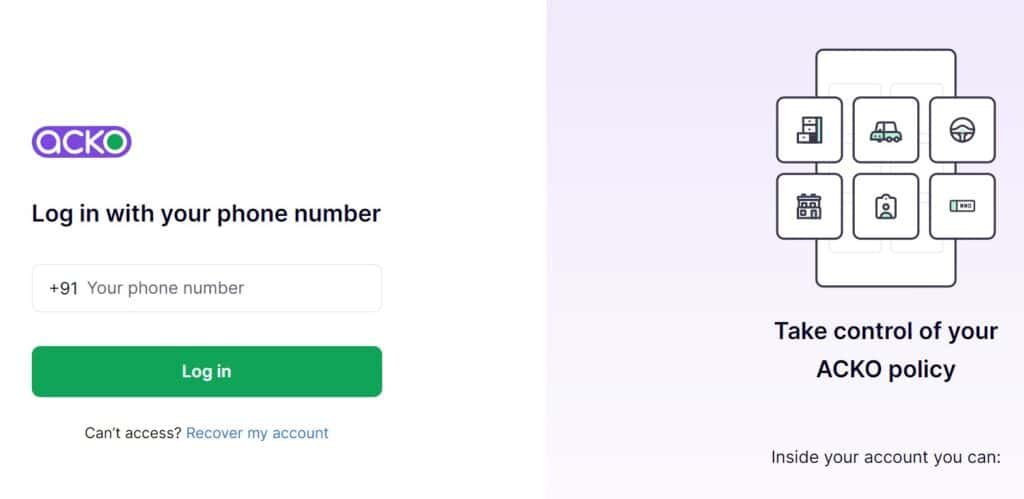

- Firstly, visit the official website of Acko, which provides all the insurance services.

- Then, again, log in to your account by entering your login details after clicking the ‘Login’ option.

- Next, you must enter the registered mobile number and the OTP you will receive.

- Next, click the ‘Claim ‘ option to raise the insurance claim on the homepage.

Benefits of Acko Car insurance:

The benefits of Acko Car Insurance provided by the company are,

- This creates a digital convenience as it is completely a digital procedure.

- Not just one, but the customers get competitive premium offers from the company.

- This is a quick insurance claim process.

- Acko Insurance service has innovative features.

- There is a feature of customizable add-on covers.

Things to remember before claiming the Acko Car Insurance:

There are a few important things that a customer has to remember before claiming the Acko Car Insurance after an accident or damage. They are,

- You must inform the company before 24 hours about the damage or accident to claim the insurance.

- Informing police is one of the first things you must do before the claim.

- You must assess your situation and claim accordingly to get the right claim offers. Use the free repair service if there is minor damage or dent.

- Enter the details carefully without making any minor mistakes.

- Communicate with a third party about the damage before claiming it to avoid confusion and ensure everything is clear.

- It would help if you abode by the law and the rules after the accident.

- Make sure to submit all the necessary documents before raising the insurance claim.

A few mistakes to avoid before raising the Acko Insurance claim:

You must avoid the following few mistakes before filing an Acko Car Insurance Claim. They are,

- There are a few situations where you do not need to claim the insurance. So avoid raising the claim during those situations, such as claiming a different one for another reason.

- You must inform the police about the accident and file an FIR to claim the insurance.

- Remember to file the insurance policy in your name if you have bought a used car.

- You must inform the Acko company about the damage before the time limit.

- As evidence is important, do not move the vehicle from the accident spot before the insurance officers arrive.

- Do not drive any insurance vehicle or other vehicle intoxicated.

- The passenger limit is one of the major factors, so do not exceed the vehicle’s passenger limit.

Reasons for Car Insurance claim rejection:

Many customers need to remember some basic things and get a rejection for their Acko Car Insurance Claim. Some of the rejection reasons are,

- In case you provide false or incorrect claim details,

- Raising a claim which is not under the policy.

- Raising a claim after the expiration.

- No reason for the claim delay.

- In case of getting the car repaired before informing the company.

- Driving without any driver’s license.

- Raising a claim on a second-hand car without legal registration.

- If the car is used for purposes other than what is mentioned in the policy.

- Driving the car intoxicated or on alcohol.

Conclusion:

Acko Car Insurance is provided by the Acko General Insurance Company, founded in 206. This completely digital insurance service became the first direct-to-consumer service that provides insurance on own damages, third-party damage or accidents. The customer can claim the charges in cashless or reimbursement form. By providing the necessary documents, the insurance holders can easily claim the insurance faster.

FAQs:

What is Acko Car Insurance?

This is Car Insurance provided by the Acko General Insurance company. It covers the charges and compensation after the car is damaged to provide financial safety.

What are the types of car insurance claims for Acko company?

Two types are primary for car insurance claims: cashless and reimbursement.

Is it okay to claim insurance on a car for minor damages?

Claiming insurance on minor damages is not advisable because you may lose your no-claim policy after the renewal.

Is Acko Insurance for a car valid outside India?

Customers can claim insurance from Acko company only if an accident or damage occurs in India.